4th August , 2018 (Saturday)

Royal Room, The Leela Palace, New Delhi, Africa Avenue, Chanakyapuri, Diplomatic Enclave, New Delhi, Delhi 110023

| AGENDA |

|---|

| 09.30 am to 10:00 am |

Tea, Assembly & Informal Networking |

||

|---|---|---|---|

| 10.00 am to 11:30 am |

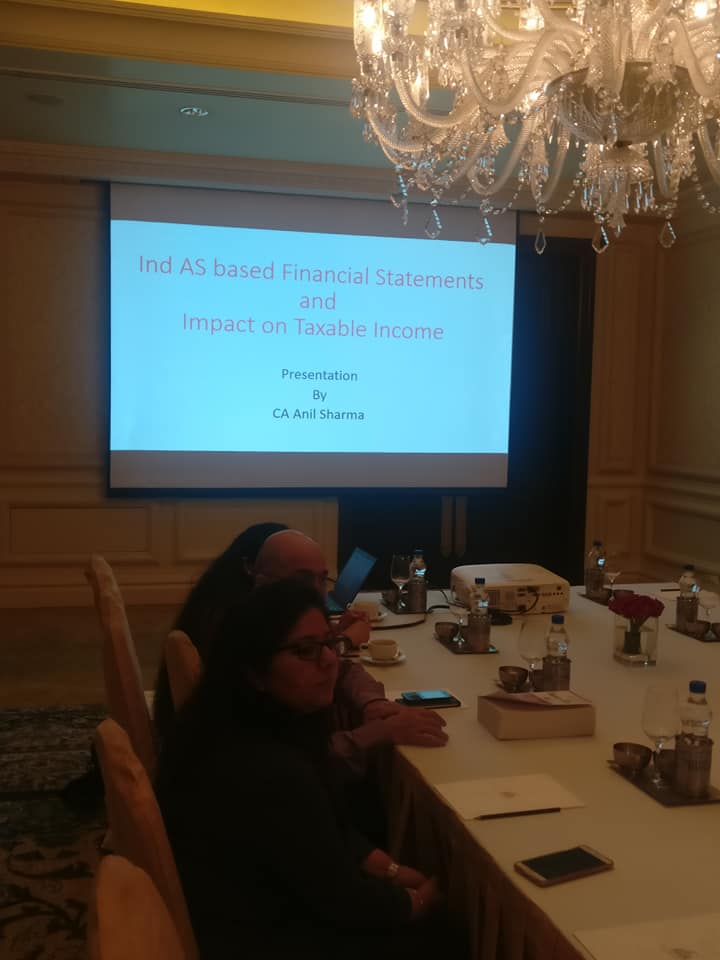

Expert Session Taxation implications and Impact of GAAP, Accounting Standards including IndAs including:

Impact on

|

CA ANIL SHARMA, FCA EXPERT

Independent Director, UCO Bank

CA RAJ KUMAR AGARWAL,

Partner, Rakesh Raj & Associates, |

|

| 11.30 am to 11:45 am |

Tea with Snacks |

||

| 11.45 am to 2:00 PM |

Expert SessionImpact of GAAP, Accounting Standards including IndAS on taxable Income (Continued) |

CA ANIL SHARMA, FCA

|

|

| Lunch (2:00 PM to 3:00 PM) |

|---|

For any queries please write to us at aicas.cfo@gmail.com or +91 9711310004