All India Chartered Accountants Society (AICAS)

CFO World and Forum of India’s Chartered Accountant Firms (FICAF)

| TOPIC: | Income Tax - Reconstitution of Partnership Firms, Deeming Fictions & Fair Valuation |

| VENUE: | India International Centre, Annexe Building, Lecture Room I, 40, Max Mueller Marg, New Delhi |

| DATE: | SATURDAY, 13th December, 2025 (8:30 AM to 5:30 PM) |

Income Tax Expert Study Group Meeting - 17

You are cordially invited for the Meeting of the “Income Tax Expert Study Group” on SATURDAY, the 13th December 2025, as per the following Programme:

| The meeting will have the following Schedule: |

|---|

| 8:30 AM to 9:00 AM |

Breakfast |

||

|---|---|---|---|

| 9:00 AM to 9:30 AM |

Inaugural |

||

| 9:30 AM to 11:30 AM |

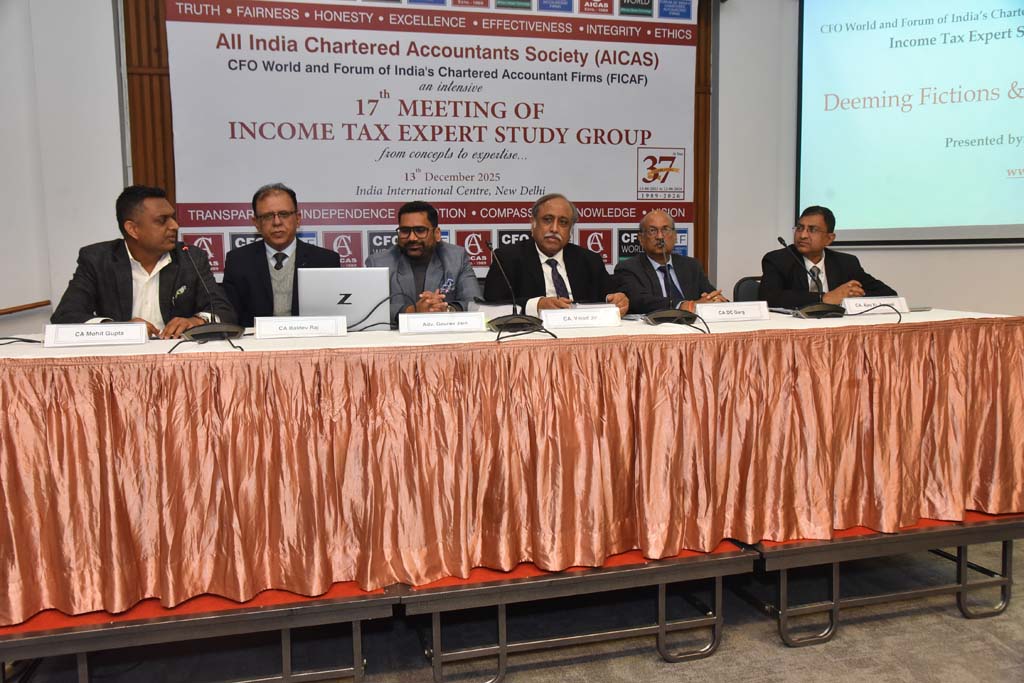

Session 1 Deeming Fictions & Fair Valuation

|

Lextone Group Law Offices |

Deeming Fictions & Fair Valuation |

| 11:30 AM to 1:30 PM |

Reconstitution of LLPs, Partnership Firms, AOP & BOI

|

CA. Ved Jain

|

Navigating the New Era of Partnership Taxation |

| 1:30 PM to 2:15 PM |

Lunch |

||

| 2:15 PM to 4:30 PM |

Case Study Based Analysis – Reconstitution of Partnership Firms

|

CA. D C Garg

CA. Baldev Raj

CA. Ajay Kumar Agrawal |

Case Study Based Analysis – Reconstitution of Partnership Firms |

| 4:30 PM to 5:30 PM |

Tea / Coffee with Cookies |

||

Brief Concept of Good and Service Tax Expert Group: The Expert Income Tax Advisory Group has been constituted to provide a forum for in-depth study of provisions of Income Tax Act and Rules and all related case laws by Tax professionals with intent to enhance knowledge and expertise. It is expected that several leading tax experts will regularly participate in the deliberations. The meeting will take place in a completely participative mode. After the subject is introduced by one person, the entire group is expected to actively participate in the discussion on the topic/case study and related legal aspects to enable bringing out all issues.

The discussion will also focus on an on-going basis as to how to present your case especially in view of mandatory e assessment; the communication expertise with substance will become more important. Now Face value will be replaced by presentation value with a mix of clarity and strategy.

Law and case laws: It is important that all participants come with advance study of the relevant law and regulations in addition to the case laws based on their own study as well as identified issues relating thereto. The original Income Tax Act Hard copy and soft copy of relevant case laws should be brought to enable in depth analysis. The facility of soft sharing with all participants will be there at the meeting.

You are cordially invited to attend this meeting of the Expert Income Tax Study group and be a regular part of this important initiative.

We would like to request you to please join the meeting. You may also bring a cheque favouring All India Chartered Accountants Society as per subscription details below.

Thanking You,

Yours Sincerely

For All India Chartered Accountants Society

Founder

President

+91 98110 40004

President

+91 98107 30568

Vice President

+91 98113 20203

General Secretary

+91 97113 10004

Co - Chair - DT

+91 99999 03556

Vice Chairman - DT

+91 98180 43245

List of members invited to join as Experts in different meetings:

You may also please join as a regular member at the earliest by sending a Cheque in favour of “All India Chartered Accountants Society”

The Membership fees for the above are as under:-

| Cost incl. GST | Meeting 17 (Single Meeting) | Meeting 17-22 (Six Meetings) |

| AICAS Members | 1,000/- | 5,000/- |

| Chartered Accountants | 2,000/- | 10,000/- |

| Others | 3,000/- | 15,000/- |

Name: |

|

|

|

|||

Membership No.: |

|

|

|

|||

Organisation Name: |

|

|||||

Address: |

|

|||||

Mobile: |

|

|||||

Email: |

|

|||||

Study Group Name |

|

Meeting 17 - Income Tax Expert Study Group |

|

Meeting 17 - 22 - Income Tax Expert Study Group (6 Meetings) |

||

Payment Details |

Cheque No. _______________________dated ____________________________ |

|||||

GST Details of Client

|

Name. _____________________________________________________________ |

|||||

FOR “ONLINE PAYMENT / DIRECT DEPOSIT CHEQUE”

| NAME: | ALL INDIA CHARTERED ACCOUNTANTS SOCIETY |

|

| BANK: | CANARA BANK, NEHRU PLACE BRANCH | |

| A/C NUMBER: | 0390101082618 | |

| IFSC CODE: | CNRB0000390 |

For other queries and registration kindly reach us on support@caworld.org or call us on 9711310004.