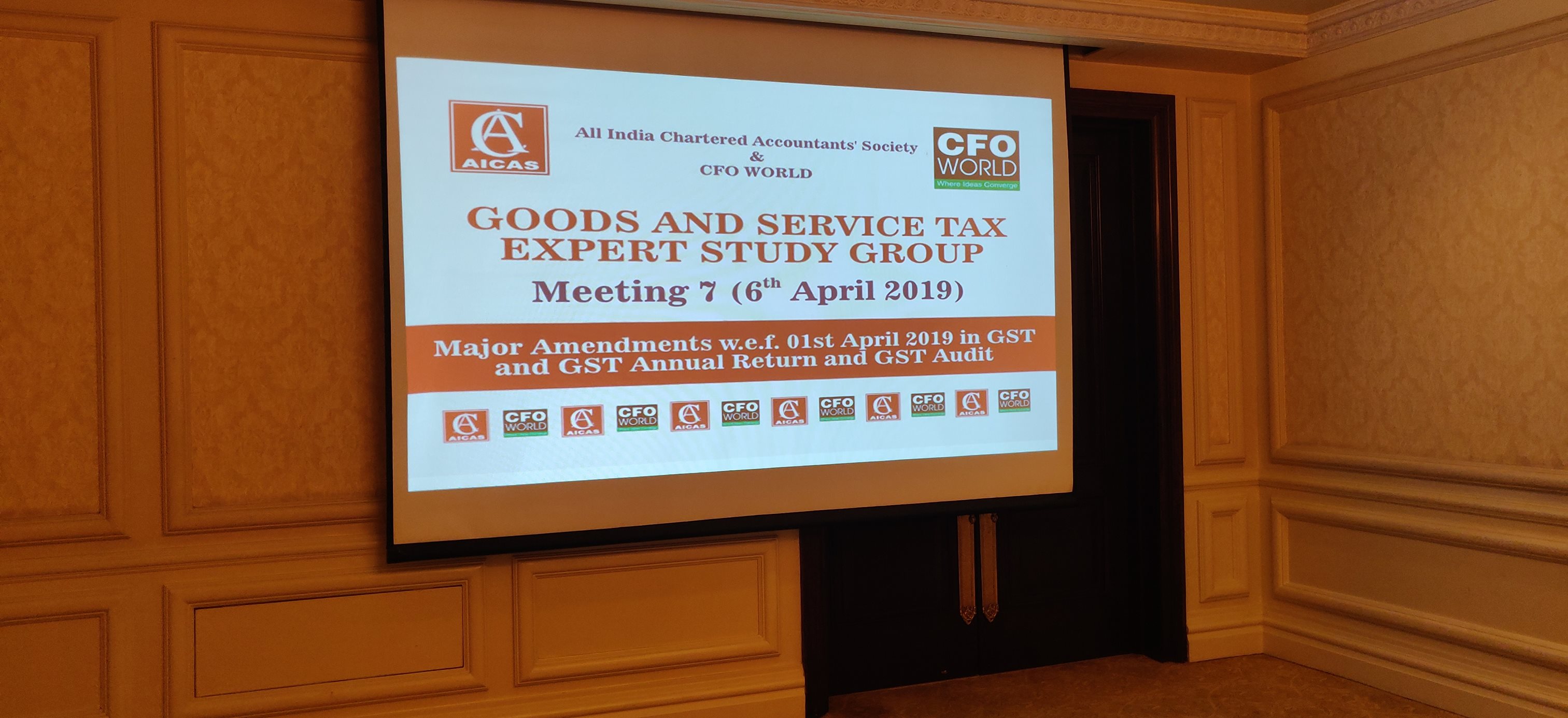

6th May , 2019 (Saturday)

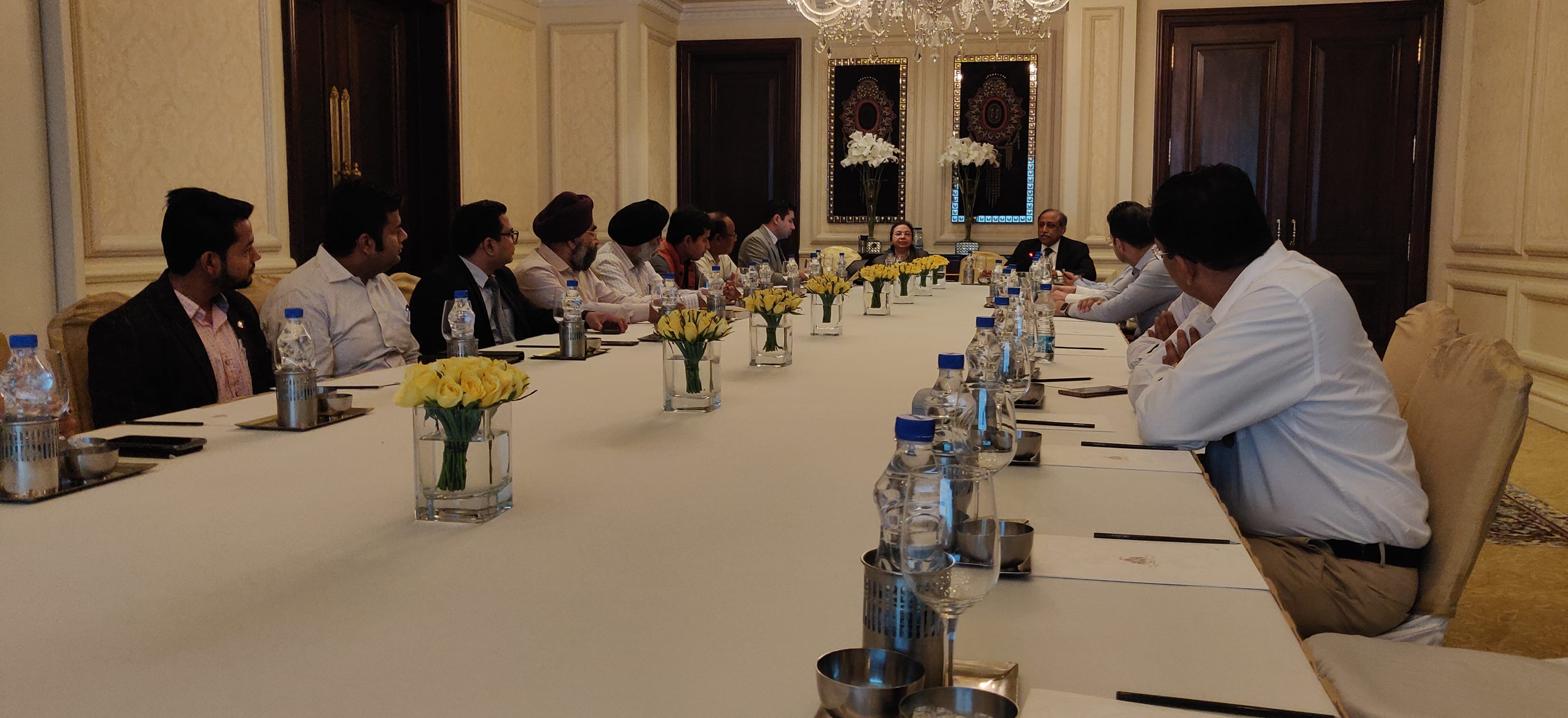

Le Cirque Boardroom, The Leela Palace, New Delhi, Africa Avenue, Chanakyapuri, Diplomatic Enclave, New Delhi, Delhi 110023

| AGENDA |

|---|

| 9.30 am to 10:00 am |

Tea, Assembly & Informal Networking |

||

|---|---|---|---|

| 10:00 AM to 11:30 AM |

Analysis and Interpretation: Concept, Analysis and Critical Issues of GSTChanges Introduced w.e.f. 01st April 2019 in Goods and Service Tax: -

|

Ms. Rohini Aggarawal,

Mr. Kulraj Ashpnani,

|

Recent Amendments Latest Update Notifications References notfctn 3 2019 cgst rate englishnotfctn 04 2018 cgst rate english notfctn 4 2019 cgst rate english notfctn 5 2019 cgst rate english notfctn 6 2019 cgst rate english notfctn 7 2019 cgst rate english notfctn 8 2019 cgst rate english Notifcation 16 CGST.pdf GST Council Meeting Press Release |

| 11:30 AM to 11:45 AM | Tea with Snacks |

||

| 11:45 AM to 12:30 PM |

Analysis and Interpretation: Concept, Analysis and Critical Issues in Changes Introduced w.e.f. 01st April 2019 in Goods and Service Tax (Continued) |

||

| 12.30 PM to 02:00 PM |

Concepts, Analysis and Insight in respect of Critical issue with respect to Annual Return and GST audit

|

Mr. Manmohan Khemka,

Mr. Vaibhav Jain,

|

GSTR 9, GSTR 9A, GSTR 9B and GSTR 9C |

| Lunch (2:00 PM to 3:00 PM) |

|---|

For any queries please write to us at aicas.cfo@gmail.com or +91 9711310004